GTA TOP PRE-CONSTRUCTION PROJECTS

GET EARLY VIP ACCESS

NAVA – OAKVILLE20230830151219

THE TRAILS OF COUNTRY LANE, WHITBY20230830130343

ARTISAN – MISSISSAUGA TOWNHOMES20230830124719

Empire Canals – Welland20230502090043

75 James Condos20221106175024

AKRA Living Condos20221106173459

DUO AT STATION PARK20221028123848

VUPOINT CONDOS 220221019132406

Highlight Condos20221005104243

NORTH CORE CONDOS20220819104743

ABOVE CONDOS – MISSISSAUGA20220816160821

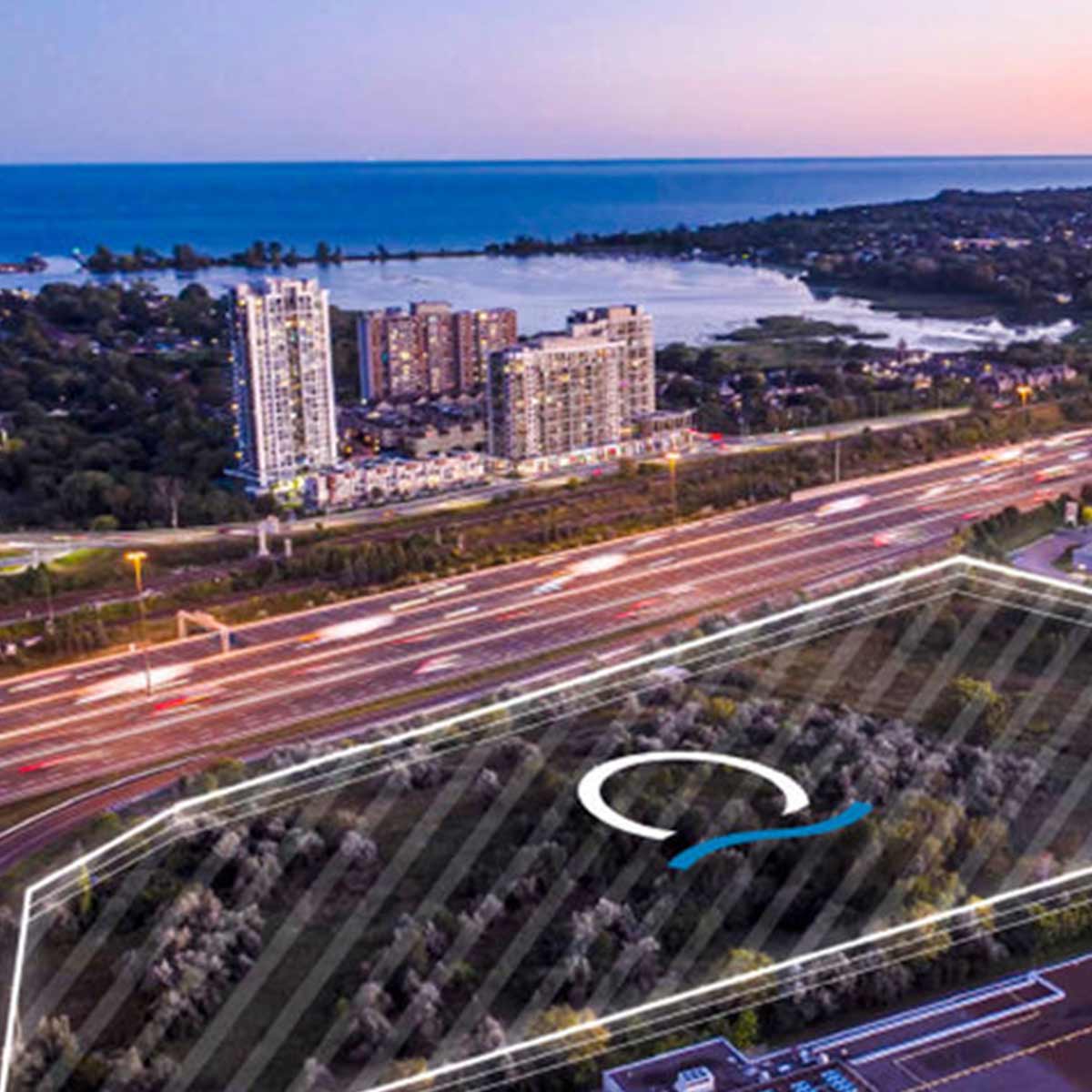

HARBOURWALK AT LAKEVIEW VILLAGE20220816160117

Bridge House at Brightwater Condos20220728151305

HORSESHOE RESIDENCES20220722131508

THE DAWES CONDOS20220719120103

VUPOINT CONDOS20220707185435

The Design District20220701124208

ALIAS CONDOS20220224234243

DUO CONDOS20220127225430

MILA TOWNS20220125164730

ARTWALK CONDOS20220120193505

252 CHURCH CONDOS20220118113721

XO2 CONDOS20220117174941

NOVU CONDOS20220113140055

MILLHOUSE MILTON CONDOS20220113091058